Eb5 Investment Immigration Things To Know Before You Get This

Eb5 Investment Immigration Things To Know Before You Get This

Blog Article

Some Ideas on Eb5 Investment Immigration You Should Know

Table of Contents8 Simple Techniques For Eb5 Investment ImmigrationThe Buzz on Eb5 Investment ImmigrationMore About Eb5 Investment ImmigrationThe Ultimate Guide To Eb5 Investment ImmigrationEb5 Investment Immigration Fundamentals Explained

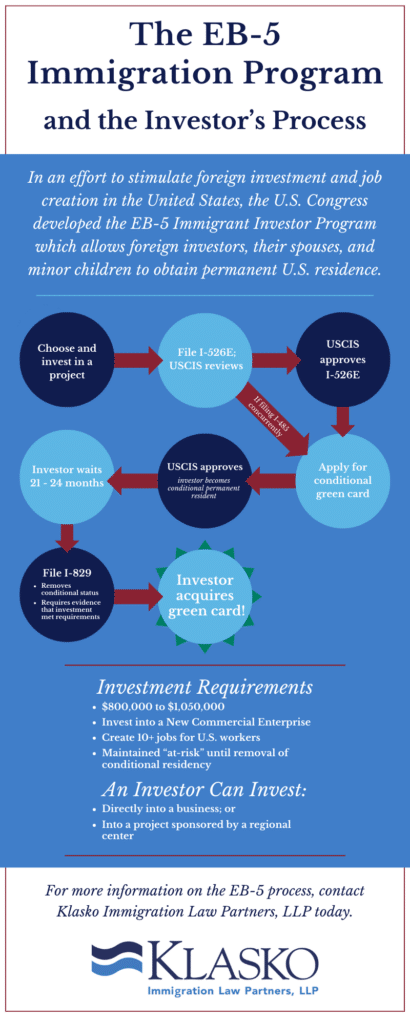

Based upon our latest explanation from USCIS in October 2023, this two-year sustainment duration begins at the factor when the capital is spent. The duration can be longer than 2 years for a couple of reasons. The most recent update from USCIS does not make clear the time frame in which the resources is taken into consideration "invested." Overall, the begin of the duration has been considered the point when the cash is deployed to the entity accountable for work development.Find out more: Recognizing the Return of Resources in the EB-5 Refine Comprehending the "in danger" demand is essential for EB-5 investors. This principle underscores the program's intent to foster authentic economic activity and task creation in the USA. The financial investment comes with intrinsic dangers, careful job option and compliance with USCIS guidelines can help capitalists accomplish their goal: irreversible residency for the financier and their family members and the ultimate return of their funding.

To end up being eligible for the visa, you are required to make a minimum financial investment depending upon your chosen financial investment option. EB5 Investment Immigration. 2 investment alternatives are offered: A minimal direct financial investment of $1.05 million in a united state business outside of the TEA. A minimal financial investment of a minimum of $800,000 in a Targeted Work Location (TEA), which is a country or high-unemployment location

The 8-Minute Rule for Eb5 Investment Immigration

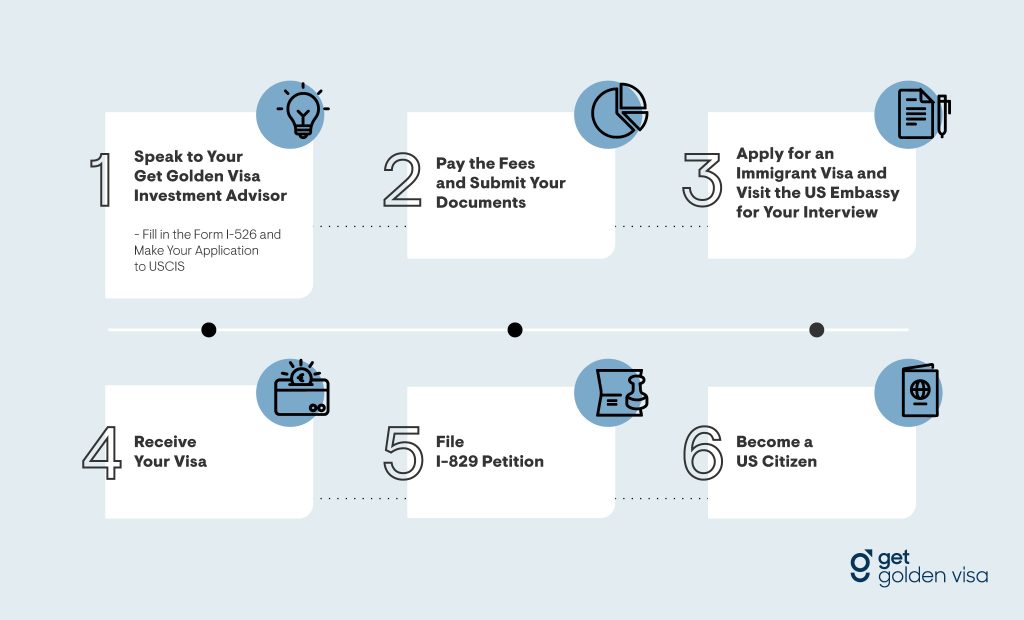

For consular handling, which is done with the National Visa Center, the immigrant visa handling charges payable each is $345. If the investor is in the US in an authorized status, such as an H-1B or F-1, he or she can submit the I-485 type with the USCIS- for readjusting standing from a non-immigrant to that of irreversible resident.

Upon approval of your EB5 Visa, you obtain a conditional long-term residency for 2 years. You would require to file a Kind I-829 (Petition by Financier to Eliminate Problems on Permanent Citizen Condition) within the last 3 months of the 2-year legitimacy to eliminate the conditions to become an irreversible citizen.

As per the EB-5 Reform and Stability Act of 2022, local center investors have to also send out an extra $1, 000 USD as component of submitting their application. This additional cost doesn't put on an amended request. If you selected the choice to make a direct financial investment, after that you would certainly require to attach a company plan in addition to your I-526.

A Biased View of Eb5 Investment Immigration

In a direct financial investment, the investors structure the investment themselves so there's no additional management cost to be paid. Nevertheless, there can be specialist charges borne by the investor to ensure compliance with the EB-5 program, such as legal costs, company strategy composing charges, financial expert fees, and third-party coverage charges amongst others.

The investor is additionally responsible for obtaining an organization strategy that abides with the EB-5 Visa needs. This added expense can vary from $2,500 to $10,000 USD, depending on the nature and structure of business. EB5 Investment Immigration. There can be extra expenses, if it would be sustained, for example, by marketing research

An EB5 investor should also think about tax obligation factors to consider throughout of the EB-5 program: Since you'll become a permanent homeowner, you will be subject to income taxes on your worldwide earnings. You must report discover here and pay tax obligations on any kind of revenue gotten from your financial investment. If you offer your investment, you may go through a capital gains tax obligation.

All about Eb5 Investment Immigration

If you're intending to purchase a local center, you can look for ones that have reduced charges yet still a high success rate. This makes sure that you shell out much less directory money while still having a high possibility of success. While hiring a legal representative can include in the costs, they can help decrease the total expenses you have to pay in the future as lawyers can guarantee that your application is total and precise, which reduces the opportunities ofcostly errors or hold-ups.

The Ultimate Guide To Eb5 Investment Immigration

The areas beyond metropolitan analytical areas that certify as TEAs in Maryland are: Caroline County, Dorchester Region, Garrett Region, Kent County and Talbot County. The Maryland Division of Commerce is the designated authority to certify locations that certify as high unemployment locations in Maryland according to 204.6(i). Commerce licenses geographical areas such as areas, Census assigned areas or census tracts in non-rural regions as areas of high joblessness if they have joblessness rates of a minimum of 150 percent of the nationwide unemployment rate.

We review application demands to certify TEAs under the EB-5 Immigrant Capitalist Visa program. EB5 Investment Immigration. Requests will be examined on a case-by-case basis and letters will certainly be provided for areas that fulfill the TEA needs. Please review the actions below to establish if your recommended project remains in a TEA and adhere to the guidelines for asking for an accreditation letter

Report this page